2020 CSP Trends

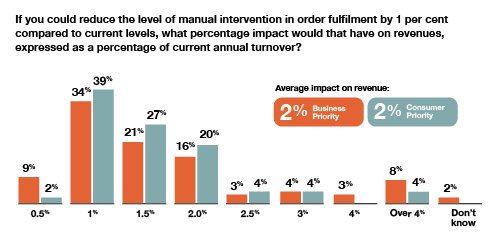

As with increased automation in sales, increased automation in fulfillment can also have a significant impact on the business. On average, respondents felt that a one percent reduction in manual intervention in order fulfillment would increase revenue by two percent or more, with services delivered to customers more quickly and with greater levels of customer satisfaction.

Figure 5 – Impact of 1% reduction of manual intervention on revenues, as a percentage of annual turnover

Source: The Sigma Create-Sell-Deliver Outlook, 2nd Edition.

As products and services get more complex and the ability to launch and deliver these propositions quickly and efficiently becomes a core requirement for CSPs, the continued need for manual intervention will become even more of a roadblock, opening the door for those unencumbered by traditional processes and approaches.

Conclusion

As we head into 2020, the evolving technology landscape is creating a world of new opportunities. But in order to capitalize on them, CSPs must be able to respond quickly and efficiently.

While time to market is a clear priority for carriers, what is equally clear is that this is not an issue of technology alone. Having the right platforms in place can drastically improve agility—but this needs to be accompanied by processes which can also enable flexibility and efficiency. The kind of timelines that look good in a telco world will increasingly look drawn out when compared with the agility of digital-born companies, many of which will rival telcos in certain parts of the value chain.

Likewise, the ability to handle more complex products and services will become a key challenge for CSPs. But our survey shows that for those that can get it right, the rewards are very real.

However, fulfillment remains a potential barrier to success, even though CSPs already have a tool in their armory which can be used to address the bottlenecks: automation. The increase in manual intervention is a worrying trend and is simply not sustainable as CSPs look to deliver more complex propositions quickly and efficiently.

A defining factor of a world underpinned by 5G and virtualized networks is that there will not be a “killer app” in the traditional sense; instead, CSPs will be presented with a broad set of opportunities across enterprise and consumer markets. And if they do not address their challenges around product creation, commerce and delivery, there is a very real danger they will not be able to capitalize on them.

The challenges identified by the second edition of the Create-Sell-Deliver Outlook are real for CSPs globally today. The evolving technology landscape will only make things worse and the message is clear: act now or lose out to those who do.