2020 CSP Trends

By: Robert Hingston

After years of hype, several emerging technologies are gradually becoming mainstream. The Internet of Things (IoT), Artificial Intelligence (AI) and 5G have been hot topics for several years—and will continue to be in 2020. Now more than conceptual, these technologies are undergoing real-world adoption, with real use-cases and real customers. This means that communications service providers (CSPs) need to be on the front foot when it comes to creating and delivering services that meet the demand for new types of complex communications services if they are to stand a chance of capitalizing on this multibillion-dollar market.

The second edition of the Create-Sell-Deliver Outlook found that there is still work to be done.

In the survey, we polled 150 service providers from around the world, including enterprise and consumer-focused respondents and across the fixed, mobile, satellite and cable/TV segments. We gauged sentiment among senior executives around key themes including the creation of new service offerings, new business models and monetizing new innovations. This is what we found.

Time to Market

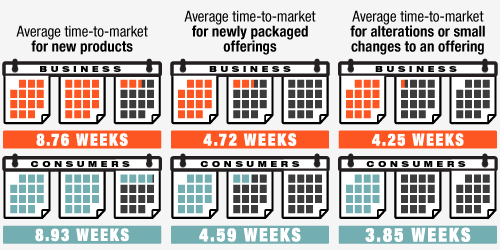

The first area we looked at was time to market. According to respondents, launching an entirely new product for enterprises or consumers takes almost nine weeks, and 98 percent cited the need for improved agility and innovation. In a world that is increasingly real-time and always-on, nine weeks is just too slow.

Unsurprisingly, 72 percent of respondents said there is a drive to reduce time to market for new products within their organizations, and the average reduction targeted is in the 14 to 18 percent range—a savings of around one week. This time savings is hardly a drastic cut, but presumably achievable, based on current conditions. An eight-to-nine-week turnaround would have been considered fast within the industry a decade ago, so things have definitely improved since then. However, with digital-first and OTT players disrupting the industry, there is no time for traditional CSPs to congratulate themselves. They are in a race to take advantage of the opportunities that 5G and IoT will provide, and their competitors are taking no prisoners.

Given that time to market is such a key factor in meeting customer demand in a fast-moving and competitive market, we looked a little deeper into this metric.

Figure 1 – Reported Product Time-to-Market for CSPs

Source: The Sigma Create-Sell-Deliver Outlook, 2nd Edition.

For newly packaged products which contain pre-existing elements, the reported time to market fell from around nine weeks to approximately five (as seen in Figure 1)—a significant improvement. This is a clear example of how having access to a catalog of components with which to build a new proposition gives a distinct advantage, increasing agility and decreasing time to revenue. However, the time to launch a product where only small changes or alterations were made—think minor pricing or device specification updates—was just one week quicker, even though the heavy lifting had already been done.

This reflects the fact that technology is not the only inhibitor here: 96 percent of respondents identified processes as a problem. So, while technology can play a critical role in improving CSP agility, there also needs to be a focus on—and streamlining of—processes in order to tackle the issue end-to-end.

Increasing Product Complexity

The second theme in the survey relates to CSPs’ selling capabilities. The industry is seeing a number of trends coming to fruition at the same time: the arrival of 5G, the rollout of virtualized and software defined networks, and the growing prominence of converged bundles in the consumer market, to name but a few. All of these add to product and service complexity. This is impacting the way that CSPs sell products and services.