Innovation, Automation and the

Path to Network Transformation

The wireless play

Cable companies are also grappling with the realities of explosive growth in connected devices. Charter Communications, for example, reports that its networks are averaging 15 connected devices per household—phones, laptops, gaming devices, printers, smart devices and so on—using the in-home Wi-Fi network. In effect, Wi-Fi and home networks are becoming increasingly important to cable’s residential strategy, with upgrades to Wi-Fi 6E and eventually Wi-Fi 7 expected to become the backbone of the residential strategy and a way to add value to residential and business customers.

By pursuing the FMC strategy over the next four to six years, and with the addition of CBRS spectrum, cable operators will be able to offload some of the MVNO workload to this converged network. “We're already doing a great job with Wi-Fi. And now that we're moving towards this converged solution, you'll be able to actually roll out services across all of these networks at the same time,” commented CableLabs Vice President Mark Bridges, part of the Future Infrastructure Group.

Cable’s next-gen platforms

Cable networks combine various flavors of the broadband access technologies, with the cable modem standard known as DOCSIS (3.1, and two different versions of next-gen DOCSIS 4.0), as well as fiber and next-gen PON, advanced digital optical technologies and wireless technologies including Wi-Fi and CBRS.

Network digitization often involves disaggregation of certain network elements. For cable, this includes distributed access architecture (DAA), which moves certain functions typically resident at cable headends or hubs closer to the user, thus reducing the amount of hardware housed at these locations and creating efficiencies in speed, reliability, latency and security in support of 10G.

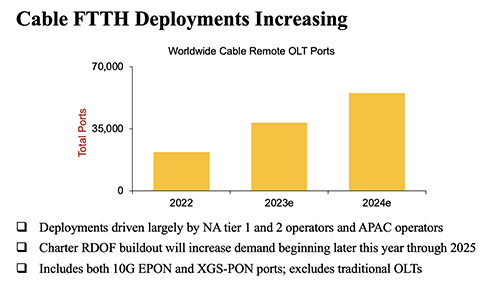

DAA is part of the larger network evolution strategy that decentralizes and virtualizes headend and network functions, and the move to deeper fiber architectures with digital service nodes that use digital optics and Ethernet transport. Jeff Heynen, Vice President, Broadband Access and Home Networking, Dell’Oro Group, told Pipeline that shipments of DAA nodes are expected to reach nearly 80,000 units in 2022 with global shipments of 112,000 DAA units forecast for 2023, skewing heavily toward North America. According to Dell’Oro Group data, worldwide shipments of remote OLT ports are expected to reach 55,189 units through the end of 2024—more than doubling from 2022 to 2024 on the expectation of more fiber deployments by operators.

Figure 1: 2022 to 2024 FTTH Deployments. Courtesy of Dell'Oro Group.

click to enlarge

“While the numbers are relatively small compared with total homes passed, the takeaway is that cable operators are gradually becoming true Multi-System Operators (MSOs) with multiple, physical layer technologies being used for residential broadband access. Part of what makes that available is the deployment of virtual CMTS (vCMTS) or Access Controllers that can abstract and virtualize hardware functionality and manage the modems and ONTs in the same manner, all the while masking some of the underlying technical differences between the technologies and vendor implementations,” said Heynen.

Companies like Harmonic and Casa Systems are among the top suppliers for vCMTS solutions to global operators. Casa, for example, has showcased a convergence use case demonstration using a 5G core, virtual Broadband Network Gateway and their vCMTS to show how operators can give customers the ability to boost their speeds for limited periods of time or for specific applications implementing virtualized solutions and software running on COTS servers at the push of a button. Harmonic, in