3 Ways to Derisk the Digital Economy

In light of these emerging opportunities, CSPs must mitigate important risk factors to ensure that the risks do not outweigh the reward of digital transformation.

De-risk Strategy #1:

Eliminate risky grey areas of accountability

Expanding the business models through partners can bring CSPs significant benefits and help bring about exciting innovation, but inevitably offers less direct control than delivering it in their own controlled environment. It is often said that a business is only as strong as the chain of suppliers it works with.

An example of how service delivery chains are becoming complex, and by doing so, becoming more difficult for handling risks, can be exemplified by Uganda’s recent hacker attack on the country’s mobile money business that processes phone-based transactions. The mobile money value chain is made up of mobile network operators (MNOs), banks, and end users and is a technology that allows people to receive, store, and spend money using a mobile phone.

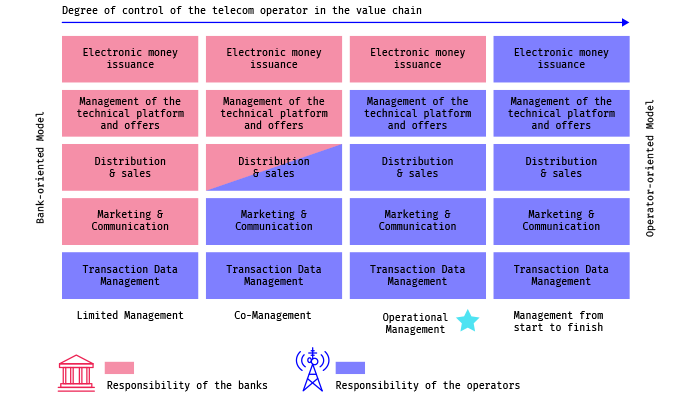

In the mobile money value chain, there are blurred risks mainly due to the ambiguous roles of banks and telecommunications companies in financial services, as proven by the recent hack of a gateway that links the bank-to-mobile money transactions. There is a clear line between “banking” and “mobile money” as a standalone business. Where lines become blurred is when MNOs expand their services to connect with banks and allow the withdrawal of money from regular ATMs.

Figure 2: Mobile money value chain

click to enlarge![]()

De-risk Strategy #2: Proactive dynamic decision-making

With digital transformation, telecom risk management initiatives are going through a massive generational shift. Traditionally, telecom value chain risk management has been heavily supported by analyzing internal events, such as network and OSS/BSS, and optimization models on internally processed data. The shift between just relying on telecom partners and having many vertical partners is pushing in favor of a more vertically integrated technology stack: the cloud. This transition offers all the stakeholders better security and innovation at a lower cost, allowing them to act fast on potential risks.

Not only will 5G-driven digital transformation deliver a massive increase in the volume of transactions, it will also generate a massive diversity of exchangeable events from a variety of partners and services that need to be monitored and analyzed in real-time.