Beyond Connectivity: An Industry Scorecard

5G Connectivity – 6 out of 10

Excellent Potential

The explosion of 5G technology is happening worldwide and represents a large opportunity to support many of the other services in this list. Its future is very bright.

Managed Security Services – 5 out of 10

Very Good Potential

DSPs are well-trusted by their enterprise clients and have shown themselves to be credible managed security service providers (MSSPs). By providing security services to enterprise networks, they are expanding their reach into the overall managed IT services arena.

Managed IT Services – 3 out of 10 – Good Potential

Some DSPs, most notably Colt and BT in the UK, have successfully become providers of multiple IT services to their enterprise clients. These range from managing an enterprise’s private network to providing customer care platforms for an enterprise’s call centers. The potential is large, especially for those DSPs that have large mobile workforces, to become major IT services providers, displacing many of the smaller players that serve small and medium enterprises.

Digital Content – 3 out of 10 – Unknown Potential

Several large DSPs, most notably AT&T and Comcast in the US, have made large acquisitions to control digital content assets. So far, however, they have not been able to gain synergy between their connectivity and content assets. With the increasing competition among other players, including web-scalers such as Netflix, the prognosis for digital content being a driver of growth is a question mark.

Global Offerings – 2 out of 10 – Unknown Potential

Early in the development of the digital economy concept, I wondered if CSPs would expand beyond their current geographic boundaries to provide more comprehensive offerings to multinational enterprises. So far, there have been few successful examples of this, with multinational companies and overlay service providers negotiating with multiple geographically bound CSPs. However, we are starting to see some service chaining that extends beyond a DSP’s geographic boundaries, as well as experimentation with exchanges, making this a potential winner in the future as DSPs offer their networks more as platforms with APIs (often called network-as-a-service arrangements).Double-Sided Business Models – 1 out of 10 – Poor Potential

There was a lot of excitement about the double-sided business model (also sometimes called the two-sided business model or platform business model) for enterprises, but it fizzled, for the most part. The concept was that the CSPs would provide more than just communications between buyer and seller (via text, voice, or data), deriving a part of the benefit of the transaction. Most often, this meant providing a catalog of items to the buyer and the transaction processing. Amazon does this, beyond selling the items itself. CSPs do, too, with accessories for their phones and some other e-commerce items. But the model has not worked out well for most and has limited potential.

Utility Computing – 1 out of 10 – Poor Potential

Early in the growth of the computing utilities, it seemed natural that CSPs would become utility computing providers. They had large data centers already, maintain good relationships with corporate clients, and provide the connectivity already. Plus, they were experts at providing complex technical operations to scale. But they were slow, while other more computing-savvy players such as Amazon, Google, IBM, Microsoft, and others grew their computing businesses quickly. The business potential for the DSPs is small.

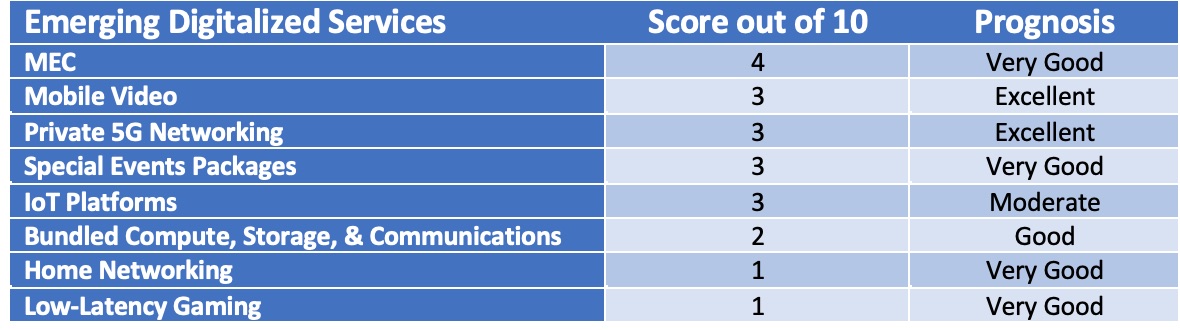

Emerging Digitalized Services

The next round of digitalized services is now reasonably understood. It remains to be seen how quickly the DSPs will attempt to capitalize.

click to enlarge