A Tsunami of Mobile Data Could Throttle Networks

By: Santiago Bouzas, Indranil Chatterjee

For global telecom operators, the last few months have been an interesting experiment. In many ways, the COVID-19 pandemic has been a scaled-down version of what might lie in store for networks as 5G is gradually rolled out.

According to a recent research report from the Technology Innovation Council (TIC), more than 40 percent of operators have seen network traffic increase between 60 and 100 percent, primarily driven by the lockdown measures imposed by countless countries around the world to combat the pandemic. Thousands of businesses were suddenly racing to enable their staff to work effectively from home, while children in many countries simply had their education paused or were homeschooled.

Either way, networks saw a sudden surge of usage as businesses, schools and families began to lean very heavily on the Internet to collaborate, communicate, and connect. While many companies thought—and perhaps even hoped—that remote working was a temporary measure, it’s becoming increasingly apparent that it may be a part of the so-called “new normal.” In fact, once they’re beyond the productivity hurdle, many businesses are actually finding remote working a very viable and cost-effective option. And that has implications for telecom operators.

Operators on the frontline…of gaming!

This level of demand isn’t going anywhere soon. As network operators continue to roll out their 5G networks, they are going to have to contend with high traffic, driven mainly by video, gaming and collaboration platforms.

Video streaming revenues alone are expected to hit $52 billion this year, according to Statista. But as 5G networks grow over the next five years, revenue from video streaming is expected to experience a 10.7 percent compound annual growth rate (CAGR), pushing the market to a staggering $86 billion by 2025. Moreover, MarketsandMarkets says cloud gaming will experience a CAGR of 59 percent, driving revenues from $306 million in 2019 to $3.1 billion by 2024.

It’s a tough challenge for operators, but it’s excellent news for gamers. Gone are the physical access barriers, such as needing a cutting-edge computer or handset that would once have stopped a player from enjoying the latest video game crop.

Cloud processing means that all the heavy lifting is done on the cloud, allowing consumers to spend more on games and less on hardware. What’s more, the super low latency offered by 5G will make gaming more viable than ever before in a wireless, hand-held format. However, gaming is a heavily segmented market. For instance, the increasingly popular e-sports market has very little in common with mobile or console gaming. When it comes to market segmentation, the strategy taken by gaming companies will have a knock-on effect on the expectations set by analysts who—at least before the pandemic—were considering it would be the 5G equivalent to video in 4G.

And this is just the tip of the iceberg when it comes to 5G use cases. By 2024, vXchnge says 5G networks will cover 40 percent of the world, handling 25 percent of all mobile traffic data. But where 5G will truly create disruptive change is in the use cases it uniquely supports.

5G and IoT

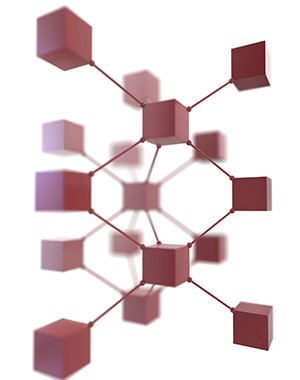

Unlike 4G’s massive cell towers, 5G networks are made up of towers of small cells that transmit data over a different part of the radio spectrum. Multiple 5G towers are deployed across a network to create interconnectivity and relay data faster. Denser towers enable 5G networks to support far more IoT devices than is possible on 4G networks.