Communications Technology News: April 2013

āThese bold moves serve notice that T-Mobile is canceling its membership in the out-of-touch wireless club,ā said John Legere, president and CEO of T-Mobile USA, in characteristically iconoclastic fashion. āThis is an industry filled with ridiculously confusing contracts, limits on how much data you can use or when you can upgrade, and monthly bills that make little sense. As Americaās āuncarrier,ā we are changing all of that and bringing common sense to wireless.ā

Toward the end of March the CSP announced the details of its āuncarrierā model, which replaces phone subsidies with payment plans and eliminates contracts in favor of simple, all-in pricing. Will its new plans be attractive enough to pull customers over from Verizon and AT&T?

āIn the end, the wild card will be how well customers understand and feel about managing a consumer BYOD and/or financed smartphone environment versus the traditional subsidy model (which for all complaints many times resulted in a free or low-cost device for an incoming customer),ā wrote Rich Karpinski, senior analyst with Yankee Group, in a March blog post. āIn particular, for customers that are very savvy, especially cost-conscious and willing to crunch total-cost-of-ownership numbers, there are cheaper deals out there than T-Mobileās Value plans ā further complicating its āuncarrierā marketing story.ā

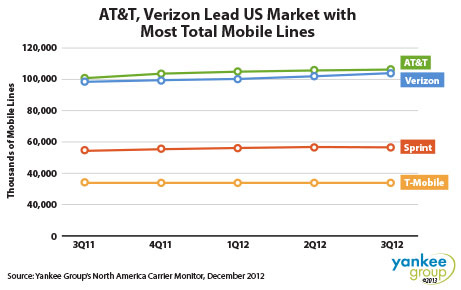

T-Mobile certainly has some catching up to do. As you can see in figure 1 below, it trails AT&T and Verizon by a substantial margin and third-place Sprint by a good measure as well.

ST-Ericsson fails

Ericsson may command the lionās share of the LTE infrastructure market, but that success didnāt translate to its four-year-old joint venture with STMicroelectronics. On March 18 the companies announced that ST-Ericsson would close its doors and lay off 1,600 employees. Silicon calculus is complicated: ST-Ericsson never made a profit, nor did it attract a buyer; in the final analysis it was simply no match for its Asian competitors.

After the split Ericsson says it will assume approximately 1,800 employees and contractors, with the largest concentrations in Sweden, Germany, India, and China. And itās proposed that ST assume approximately 950 employees, primarily in France and Italy, to support ongoing business and new product development within the Swiss company. The joint ventureās operations will be divided accordingly:

- Ericsson will take on the design, development and sales of ST-Ericssonās LTE multimode thin-modem products, including 2G, 3G and 4G;

- ST will take on all other existing products and related business as well as certain assembly and test facilities;

- Starting the close down of the remaining parts of ST-Ericsson.