Why Is a Mobile Operator Selling Groceries? Because It Can.

By: Becky Bracken

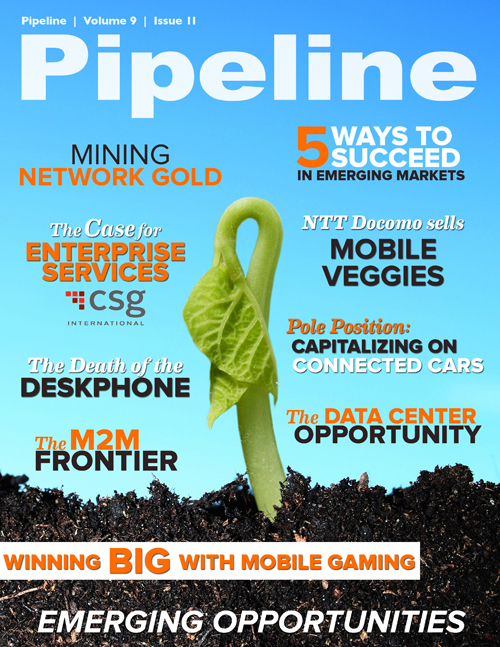

In Japan earlier this year NTT Docomo announced a partnership with local organic-foods retailer Radishbo-ya. At first glance a mobile operator selling organic vegetables seems like an odd move, but Docomo is predicting that its entry into eight new vertical markets — media content, aggregation platforms, safety and security, healthcare, ecology, M2M (machine-to-machine communications), finance, and commerce — will net an additional one trillion yen in revenue, or roughly $10.7 billion, by 2015.

NTT Docomo’s alliance with Radishbo-ya is just one example of a recent trend that’s seen communications service providers (CSPs) moving beyond simple connectivity as a core revenue generator and into the monetization of network assets by providing a whole new world of services to customers. Docomo’s fleet management services, online retail capabilities and overall business-intelligence (BI) functions are poised to supercharge Radishbo-ya’s decidedly un-digital organic-grocery outfit. And that’s just the beginning.

From farming and home security to healthcare and beyond, mobile operators are getting into all kinds of new businesses. Why? Because their big, beautiful, brilliant networks say they can. And even though the services they’re delivering seem increasingly exotic, it’s still the networks’ flexibility, intelligence and reliability that make it all possible.

AT&T recently launched its souped-up Content Delivery Network for business, which utilizes Akamai’s CDN infrastructure. Enterprise customers are expected to benefit from more streamlined content routing and better distribution of digital content, video and web applications, resulting in a better end-user experience.

“Enterprises today need to deliver rich content to their customers efficiently, at a high quality level and in the format the customer desires,” says Cindy Whelan, principal analyst of business-network and wholesale services at Current Analysis. “Services like AT&T Content Delivery Network can assist enterprises in meeting these requirements by enabling them to manage, maximize and accelerate the flow of digital assets, creating seamless mobile and web experiences regardless of [the] device.”

Not surprisingly, AT&T’s biggest competitor is joining the race. “Through its partnership with Redbox, which traditionally has existed as a physical DVD-rental box, Verizon is able to offer its high-capacity internet backbone network to allow Redbox to reach more customers,” says Jon Pelson, head of JDSU’s wireless segment. “This helps Verizon further monetize its existing network and Redbox to deliver high-quality video content on demand. Verizon wants to add value to this experience and have more control over the delivery of content.”

Meanwhile, Telefónica is investing heavily in M2M. Its in-house research-and-development, or R&D, team has created a web-based platform to manage and monitor M2M communications, and the CSP’s new Smart M2M Solution leverages local operations to offer customers a service that adapts to their specific needs. For example, they can receive customer support in their native language over a locally maintained network and use local SIM (subscriber identity module) cards, with data being confined to the country that’s complying with local regulations.

“The visibility and management of machine-to-machine communications is a vital component of any successful deployment,” says Carlos Morales, director of M2M and cloud at Telefónica Digital. “By matching our technical expertise and experience in M2M with our local knowledge, we have been able to develop a simple and flexible platform that can give our customers a complete and precise view of their business processes.”