Converting Data Centers Into Revenue Centers

By: Jim Poole

Location confers powerful advantages, and no one understands this better than bricks-and-mortar retail chains. Choosing where to put a new store can be such a big differentiator that many companies, particularly Starbucks and Walgreens, guard their site-selection processes like trade secrets. To help maximize return on investment (ROI), retailers often evaluate hundreds of empirical-data sources and subjective indicators, and through trial and error the industry as a whole has amassed volumes of research and decades of best practices in order to improve the science and art of site selection.

When it comes to network services, location means just as much to communications service providers. Unlike bricks-and-mortar retailers, however, CSPs are just beginning their site-selection journey. And though they’ve long appreciated the importance of strategic colocation, the criteria that define a “good” location are changing fast as new revenue opportunities open up around network-centric services centered on mobile broadband, content streaming, IP (internet protocol), and the cloud, permanently altering how CSPs select new sites for network expansion.

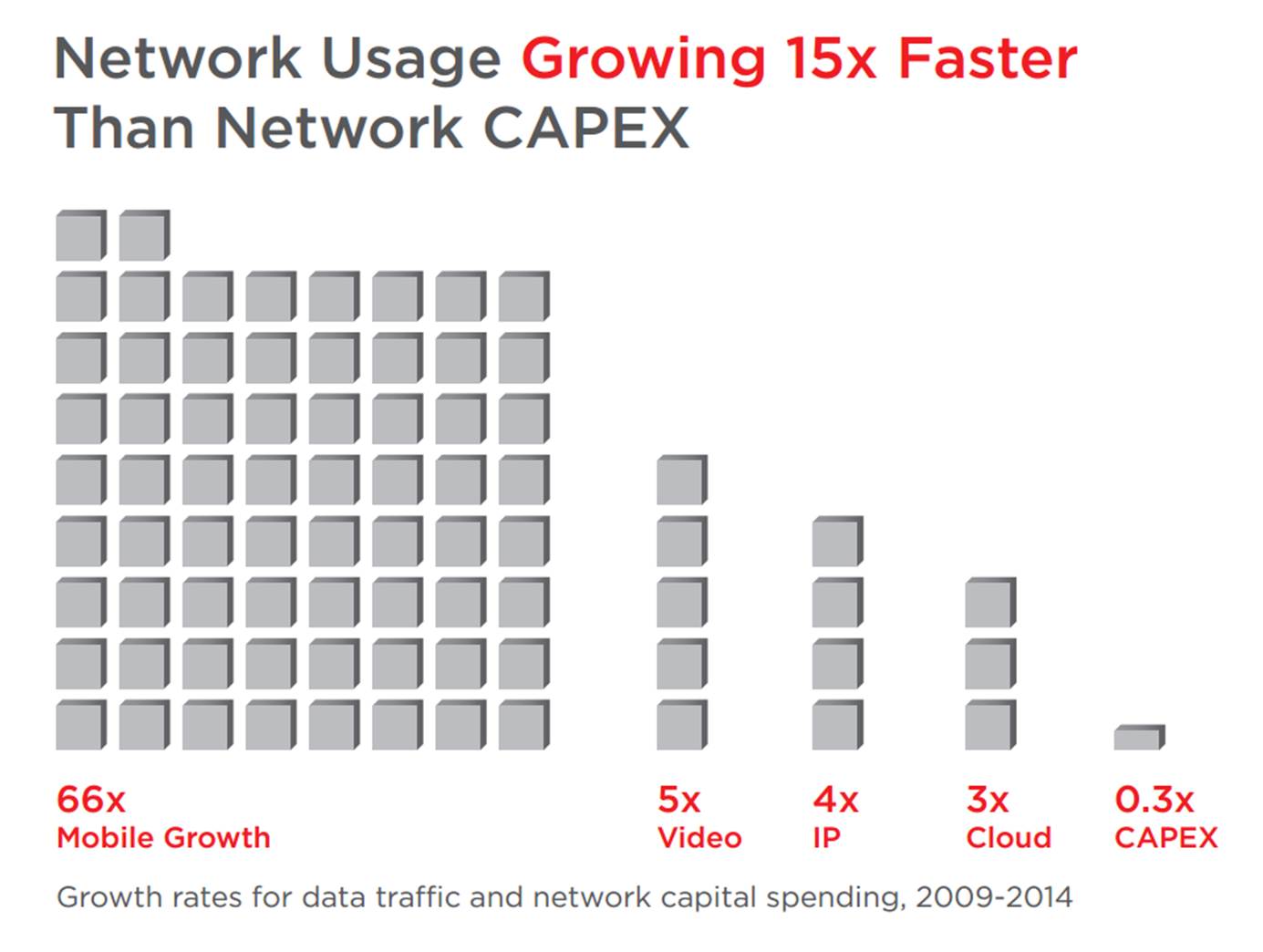

Consider these growth statistics:

- The cloud-services market will increase threefold, from $50 billion to $150 billion, swelling traffic primarily for business IP and private networks. (Gartner)

- Mobile data is predicted to double from this year to the next. (Cisco Visual Networking Index)

- Internet video alone will make up 57 percent of all consumer internet traffic and constitute nearly two-thirds of all mobile traffic by 2014. (Cisco Visual Networking Index)

- All forms of global IP traffic will quadruple. (Cisco Visual Networking Index)

Equinix’s analysis of industry data reveals that network usage is growing about 15 times faster than investment in network capacity; CSPs must increase their bandwidth to keep up with the skyrocketing number of cloud, mobile, content, and IP services. Yet what provider is willing to pony up enough capital investment to expand capacity to match the 300, 500 or even 6,600 percent rise in demand? Then again, looking at the upside, what kinds of revenue gains could CSPs realize if their share of these services grew in proportion with the market?

CSPs will inevitably expand their networks’ capacity, but how they choose to invest in expansion will make a huge difference in their revenue opportunities. In network services, as in retail, it’s all about location, location, location.