Trends in Enterprise-class Wireless LAN

Explosive Growth and Real Innovation

- Whether the campus NaaS offer is outcome-based. For instance, the price is based on floor area or number of employees, instead of being based on the sum of the underlying technology components. An outcome-based structure transfers responsibility for the network design and performance to the service provider.

- Which entity retains ownership of the equipment: the enterprise, the vendor, the MSP, or a third-party company providing financing.

- Whether the offer is inclusive of all life-cycle services, and whether these services are provided by an MSP, directly from the vendor, or some combination of the two.

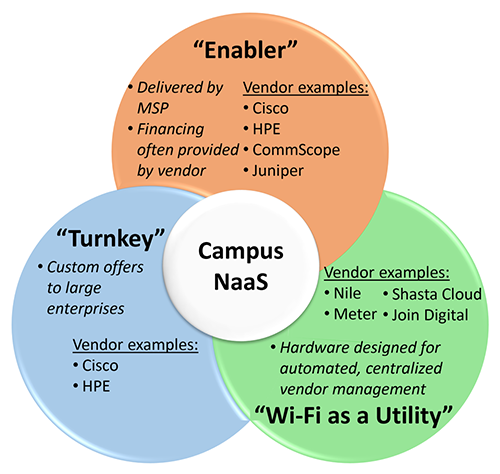

All the Campus NaaS offers available today have one thing in common: they aim to simplify IT for enterprises and reduce upfront capital expenditures in exchange for a contractual commitment. The available offers can be loosely grouped into three overlapping categories.

Source: Dell’Oro Group

Most of the incumbent WLAN vendors offer the “Enabler” variant of Campus NaaS. The vendors deliver hardware and software to MSPs, who wrap the technology in professional services for enterprises. Vendors such as HPE and Cisco also provide “turnkey” Campus NaaS offers for large enterprises. These offers include custom designs and direct delivery of complete “day-2 operations” by the vendor, in addition to hardware financing.

Startups have also identified an opportunity to carve out some of the revenues in the expanding WLAN market by offering the “Wi-Fi as a Utility” variant of Campus NaaS. The new entrants have developed specialized technology to automate and centralize network management. These companies generally deliver their own life cycle services to enterprises, although also work with MSPs for some facets. “Wi-Fi as a Utility” offers can be coupled with vertical-specific applications (for example, asset tracking or office utilization monitoring), letting enterprises benefit from value-added applications while taking their Wi-Fi network for granted.

We do not expect that enterprise-class WLAN revenues will continue to expand at the current pace for many more quarters. Once vendors have worked through their backlogged orders the industry should experience a pause, or digestion period, as excess inventory is absorbed.

However, the reader should not be fooled into thinking that a slowdown in revenues reflects the diminishing importance of LAN connectivity solutions. Enterprise demand for high-performance Wi-Fi is very real and continues to grow. The allocation of more spectrum, technological breakthroughs, and new commercial structures are combining to uncover opportunities for enterprises to increase their efficiency – and these advancements are still in their infancy. The WLAN market is evolving rapidly, and the future looks bright for enterprises able to capitalize on these innovations.