Wireless, Broadband, and Wholesale Trends

Broadband providers: two-sided business models and serving corporates

The environment for the fixed-line or broadband CSP is just as dynamic as its wireless counterparts. Here too, the increasing use of data communications for both personal and business use drives network expansions for capacity and quality of service; these expansions include ongoing investments in FTTx, IMS and LTE. After about five years of trials, and a year or so of limited rollouts, the big push seems to now be under way. With the likes of AT&T announcing $14 billion network-expansion initiatives such as Project Velocity, the stage is set for the next evolution of fixed networks and the eventual merger of fixed networks with mobility enabled by standards like IMS/LTE.

To generate returns on investment in these network rollouts, and recognizing that consumer services are generating increasingly small margins, broadband CSPs are focusing on two other sectors that remain attractive: wholesale models and enterprise sectors.

Wholesale models come in different forms, including:

- Opening up networks to third parties to market to and directly service consumers. The increased speeds, through both network upgrades and the rollout of brand-new “national broadband networks” in markets as diverse as Australia, Singapore, Vietnam, Peru, and Brunei, will stimulate a raft of new services and new business models to support them. Many CSPs will increasingly focus on wholesale relationships with these third parties, and must ensure the right systems and processes are in place to provide auditability, reporting, service-level monitoring and financial account management.

- Machine-to-Machine (M2M), and the role of the network in an M2M model, is the quintessential CSP wholesale business opportunity. M2M applications will be developed by experts across a number of industries — healthcare, transportation, utilities, etc. — and though CSPs desire to fulfill a variety of roles in this arena across the value chain, the one role they will consistently play will be the wholesale provider of network connectivity, services and bandwidth.

Wholesale partners within and without the communications arena demand to be treated with the same service levels that customers expect, and CSPs are increasingly ensuring that their organizations are geared up to manage these processes. But it doesn’t end with the focus on wholesale partners: one retail-customer segment that will garner continued CSP attention in the near term is the corporate segment.

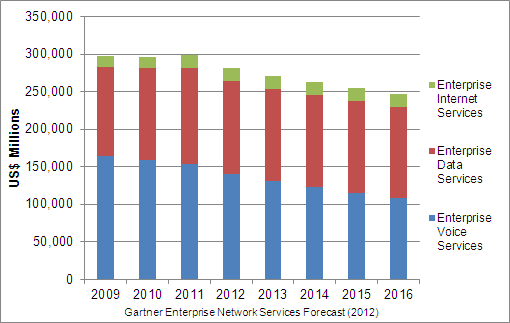

For many CSPs struggling with declining voice revenues and shrinking data margins on the consumer side, the enterprise segment — both SMB and large corporate — is the fastest-growing part of their business. The good news is that bandwidth requirements for the segment will grow on par with the market overall (a 20-50 percent average increase in enterprise-services space through 2016, according to Gartner), driven by the increasing demand for video, data and applications. Traditional enterprise-network connections such as leased lines and legacy-packet networks will be replaced by IP VPN, Ethernet and xDSL, which provide greater capacity and data-service quality at a lower cost. This transition will place downward pressure on prices and revenue, and in fact the overall revenue from enterprise services is forecast to decline over time.