Wireless, Broadband, and Wholesale Trends

The rush to real time

Managing services, entitlements and financial control across increasingly complex consumer-device relationships is just one of the drivers pushing a CSP’s solutions and processes into real time. Another is the growth in sheer transaction volumes across mediation, billing and other revenue management systems, driven by increasing device, network and service sophistication. Increasingly, volumes are so high that they can’t be stored and processed in batch mode — they need to be dealt with immediately or not at all.

Developing opportunities

Developing markets continue to present significant opportunities for growth through new customer acquisition, but growth slows as penetration levels peak. This deceleration coincides with network upgrades to high-performance 3G and 4G in many regions. For example, with the expanding availability of affordable smartphones and tablets, Informa reports that the race to make Africa wireless will be won by mobile carriers who can connect almost half a billion new customers to the internet by 2016.

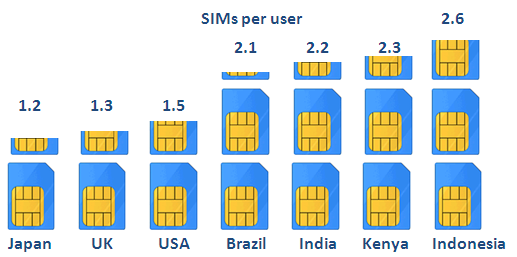

SIMs per user (source: Wireless Intelligence)

In light of the oncoming wave of data demand, CSPs in developing regions are shifting focus to data- and content-centric services. Mobile payment services are proving highly successful in markets where banking is limited, and many carriers are starting to work with internet content players to offer joint propositions that recognize the universal appetite for Facebook, YouTube and other social-networking applications.

Emerging markets offer other complications. These are often multi-SIM markets where the average user has at least two SIM cards from competing operators and switches between them based upon the best deal at any given moment. Subscriptions are predominantly prepaid, so networks and business support systems (BSS) must monitor subscriber activity in real time, responding with customized offers to persuade a subscriber to transact his or her next data event on their network.4G: the monster over the hill?

What is consistent across developed and developing wireless markets is the ongoing phenomenon of advancing to “the next G.” By mid-2012 the number of operators around the globe who had announced large-scale LTE deployments neared 350, led by the United States and certain APAC markets like Korea and Japan. In July half of the world’s 27 million LTE subscribers were based in the US, according to the GSM Association, a fact partially attributable to price plans competitive to 3G in US markets, promises of greater speed and the early availability of LTE devices. In European markets, by comparison, where LTE services have typically cost more, 1.5 million users in 21 countries had subscribed to LTE by mid-2012.

As network upgrades advance everywhere, as CSPs push to transfer subscribers from old networks to new ones, and as the 500-odd LTE devices currently being developed hit the market, adoption will accelerate in all regions. CSPs must ensure they have the processes in place to extend LTE access to new and existing customers while continuing to expand the bundle of content-related services they offer and consider whether LTE opens up significant new service-revenue opportunities. One area that shows real potential is consumer-and-enterprise cloud-based services, which will become much more credible with the extension of “real” broadband on the mobile network, making access to cloud-based data and services more or less ubiquitous while ramping up the amount of data exchanged across the network between customer and application.