Mobile Mash-up 2013: The Changing Competitive Landscape in the US

The next generation

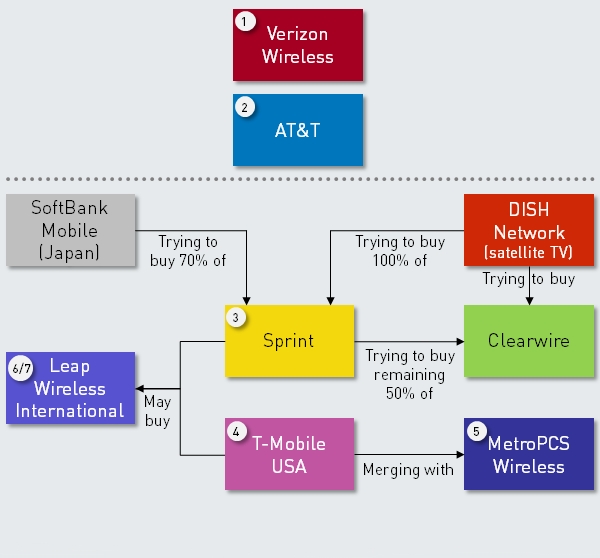

“Spectrum policy in the USA has led to an imbalance of spectrum assets among the mobile operators and created a marketplace for operator-to-operator transactions,” wrote Philip Bates, senior manager at Analysys Mason, in a recent article on the consulting firm’s website. And as figure 4 illustrates, beneath the twin towers of Verizon and AT&T, the wireless market is undergoing the greatest amount of change and consolidation we’ve seen in years.

Source: Analysys Mason, 2013

Although virtually all of the potential mergers and acquisitions mentioned here are spectrum bids, the movement reveals the changing nature of the telecommunications business. In order for MNOs to deliver the service experiences their customers desire at a tolerable price point and continue to generate profits, they simply must be able to leverage the power of next-generation networks.

Serving the whatever-whenever-wherever generation with greater and greater volumes of mobile data is no easy task—adding the iPhone 5 or even free calling after five isn’t enough. To effectively compete in the US mobile landscape, service providers must have pervasive LTE network coverage. For most MNOs, joining forces is the only option.