Mobile Mash-up 2013: The Changing Competitive Landscape in the US

By: Jesse Cryderman

When it comes to the global telecommunications landscape, competition is highly dependent on geographic and demographic differences, and these varying conditions necessitate divergent operating strategies. As Pipeline reported in April, communications service providers (CSPs) in emerging markets are investing in localization, low-cost devices and subsidized access to get a jump on their competitors.

In supersaturated markets like South Korea, where smartphone and 4G LTE penetration is 100 percent, customer experience is the new battleground, and CSPs are busy trying to differentiate themselves with engaging service experiences and content. European operators are feeling the pinch of an ongoing economic recession and, not surprisingly, are locked in a fierce price competition. And in the United States spectrum limitations, 4G LTE network deployment and the need for pervasive coverage are prompting mobile network operators (MNOs) and multisystem operators (MSOs) to embrace mergers-and-acquisitions (M&A) strategies.

Perched on the doorstep of duopoly?

One of the biggest decisions that outgoing FCC chairman Julius Genachowski made during his four-year tenure was the 2011 blockade of AT&T and T-Mobile’s proposed merger, on the grounds that it would negatively affect the competitive climate and consumer choice. “Competition is the lifeblood of our free-market economy,” he said last November in a speech before the Council on Foreign Relations. “The mobile marketplace two years ago was on the doorstep of duopoly. But our rejection, along with the Justice Department, of the proposed AT&T/T-Mobile deal, and other procompetition actions we’ve taken, have led to an improving competition picture in the United States.”

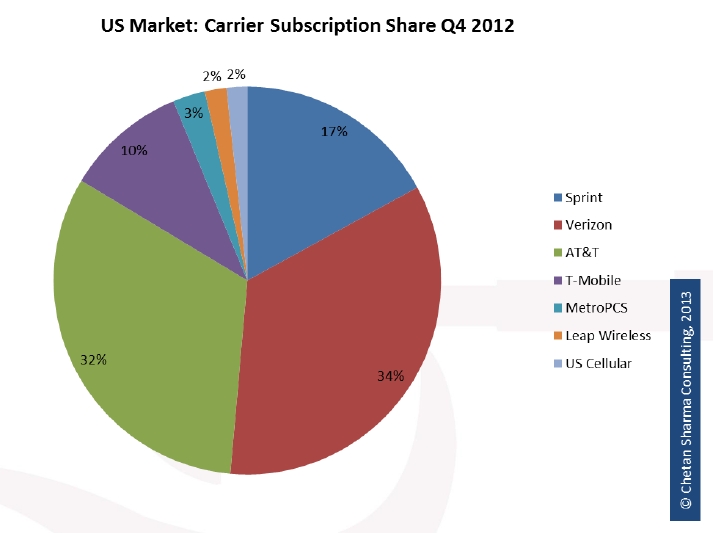

The problem with the chairman’s self-congratulatory speech is that the competitive landscape still isn’t that competitive. As you can see in figure 1, Verizon and AT&T command two-thirds of the stateside wireless market.

The Telecommunications Act of 1996 was designed “to let any communications business compete in any market against any other,” but only 17 percent of the US population receives wireless service from a company other than Verizon, AT&T or Sprint. If you’ve been working in telecommunications since it was solely a landline business, you should recognize a pattern: in 1984, following a landmark antitrust lawsuit filed by the US Department of Justice, AT&T was split into seven regional Bell operating companies (RBOCs), or “baby Bells.” But almost 30 years later, as a result of various mergers and acquisitions, only three are left: Verizon, CenturyLink and the rebooted AT&T.