Achieving Pole Position in the Connected Car Ecosystem

Embedded: Both the connectivity and the intelligence are built directly into the vehicle, and typical services include automated safety and roadside assistance, collision reporting, mobile office, and speech to text/text to speech, not to mention advanced navigation and automaker-branded infotainment. Chrysler’s Uconnect system utilizes Sprint Velocity, the CSP’s embedded platform for connected cars that in turn utilizes the strengths of telematics service providers like Airbiquity and WirelessCar as well as Aeris, which specializes in machine-to-machine communications, or M2M.

Tethered: The intelligence and applications reside in the car, but connectivity is delivered through an external source such as a smartphone. Some analysts feel that the tethered approach is essential for accelerating connected-car adoption, and will function as a middle-of-the-road alternative to either fully embedded or smartphone-integrated solutions. Japanese mobile operator SoftBank is actively pursuing tethering for low-cost solutions with Toyota, Nissan and Honda. It lets customers use their existing data plans to activate connected-car services for just 210 yen, or about $2.16, a month; as a result, SoftBank has attracted new customers and, by encouraging a higher consumption of services, increased its average revenue per user (ARPU).

Smartphone integrated: The bring-your-own-device (BYOD) option: driver has smartphone, smartphone has apps, apps show up on connected car’s dashboard monitor. Connectivity is based on integration between the car and the driver’s phone, but the latter’s initial connectivity and intelligence remain intact.“Integrating the smartphone into consumer cars represents a new route for the mobile internet and [allows] infotainment to enter the vehicle,” wrote Juniper Research associate analyst Anthony Cox in a recent report.

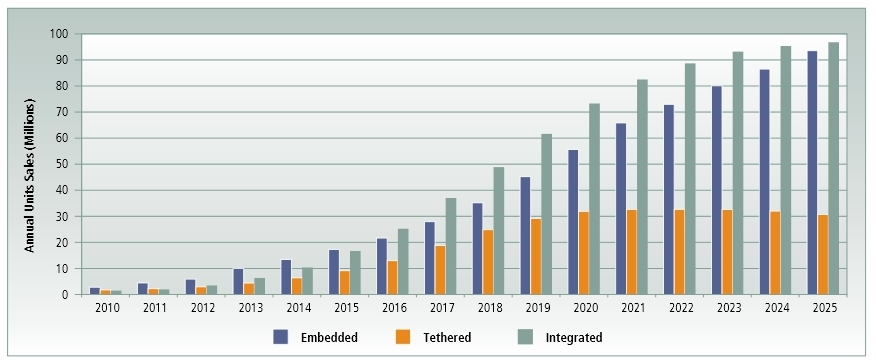

As you can see in figure 1, embedded and smartphone-integrated solutions will eventually dominate the market.

Global sales forecast of automaker connectivity solutions for passenger cars (Source: SBD/GSMA, “2025 Every Car Connected: Forecasting the Growth and Opportunity”)

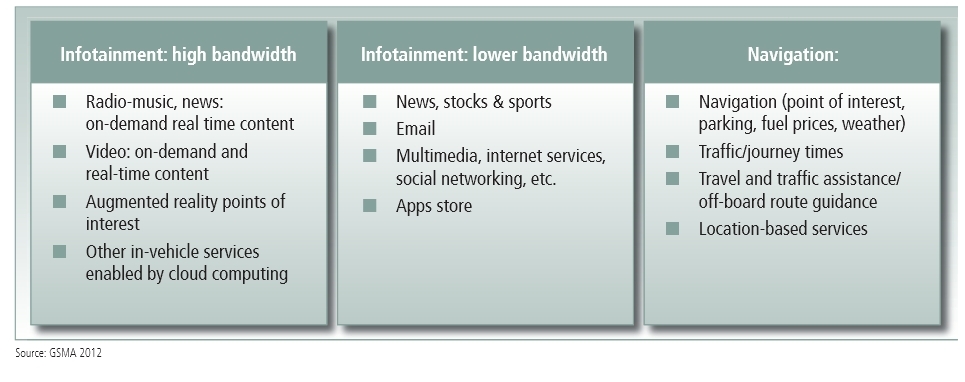

At the same time, the service landscape has changed immensely, as you can see in figure 2. Services in the modern connected car consume varying degrees of bandwidth and have varying priority requirements — collision warning and reporting, for instance, take precedence over streaming music — yet are delivered simultaneously. An advanced policy engine is crucial in order to properly deliver and manage the in-car experience.

Be prepared: curves ahead

After visiting the Car Connectivity Consortium at Mobile World Congress in February, hearing from the Autotech Council, attending a BMW webinar, and spending many hours in briefing rooms with key players, I can sum up the collective wisdom: prepare for curves, because there’s no single roadmap to success. In order to take the lead in connected cars, CSPs must have a multipronged, agile strategy that accommodates a myriad of use cases, billing models and service strategies.