The Copper Conundrum for Fixed Broadband Operators

But the downside with FTTH is that it is time consuming to deploy. According to a study from Heavy Reading, you need at least 10 years just to cover 50% of households in a nationwide FTTH deployment. Will customers wait that long? Will governments and industry regulators? Indeed, can operators even afford to wait that long in the face of increasing competition?

The answer to all three questions is “no". And that is what is driving continued development of and investment in copper technologies: to ensure operators can meet demand for ultra-broadband without delay while continuing to roll out FTTH over the longer-term.

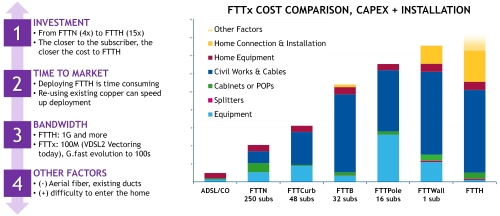

Figure 2: FTTX Cost Comparison

Time-to-market isn’t the only consideration, however. FTTH is also costly to deploy compared to upgrading existing copper lines. That’s because it requires digging up every street and/or going into every home to install new fiber infrastructure. Indeed, most of the cost of FTTH can be attributed to civil works and the home connection.

So any scenario that avoids these factors has significant cost advantages. For example, a fiber-to-the-building deployment using G.fast – or in the future XG-FAST – is about 30% cheaper than FTTH. Fiber-to-the-wall is broadly comparable to FTTH as an operator still has to bring the fiber very close to the home and, in addition, cost per subscriber increases as fewer homes are connected to each node.

Copper improves ROI

But here’s an interesting point to consider. The quick time-to-market of upgrading copper broadband means operators can generate an immediate increase in revenues. Customers will pay more for a faster connection but also subscribe to premium services like IPTV. These new incremental revenues then help fund FTTH deployments.

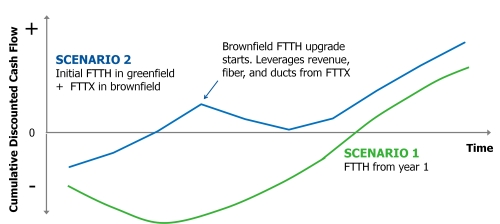

Take a look at the scenario in Figure 3. Initial capital investment is lower as there’s a mix of FTTH and FTTX, so the return to positive cash flow is faster. The profits accrued then offset the second wave of capital investment, which again accelerates a return to positive cash flow. " style="background-color:#ffffff">And, of course, a big part of the FTTX investment – the outside plant infrastructure – can be leveraged when an operator goes to full FTTH.

Figure 3: Simulated profitability of FTTH and FTTX Strategies

Source: Bell Labs modeling

So while it’s obvious that a greenfield deployment should get FTTH from the word go, the business case is not so clear cut in brownfield deployments. That’s why, over the last 12-18 months, we’ve seen many operators starting to complement their FTTH strategies with FTTX. In fact, it might not be possible for many years – if ever – to draw fiber to the living rooms of customers in the protected apartment buildings of old city centers. In these cases, FTTX is clearly the best option.

In other words, as long as it can provide ultra-broadband speeds, there is a copper-bottomed argument for continuing to invest in copper: not to replace FTTH but as an accelerator in longer-term FTTH deployments.