Software Platform-Driven Transformation

of the Broadband Access Network

By: Alan DiCicco

Internet access is increasingly the only network operator-provided service valued by the residential and small business customer, making it challenging for service providers to offer value to their

subscribers. When switching costs and differentiation are low, the ability to satisfy and keep paying customers over the long term becomes difficult. Consumers today have a deeper relationship with

the media streaming into their homes and the devices that automate their daily habits than the network that actually delivers these services. The traditional view of broadband access is dead. To be

successful, service providers must leverage software platforms to transform their business, network, and operations to compete for subscribers in ways that are both familiar and alien.

Internet access is increasingly the only network operator-provided service valued by the residential and small business customer, making it challenging for service providers to offer value to their

subscribers. When switching costs and differentiation are low, the ability to satisfy and keep paying customers over the long term becomes difficult. Consumers today have a deeper relationship with

the media streaming into their homes and the devices that automate their daily habits than the network that actually delivers these services. The traditional view of broadband access is dead. To be

successful, service providers must leverage software platforms to transform their business, network, and operations to compete for subscribers in ways that are both familiar and alien.

The business of providing broadband service – collecting a monthly fee to connect a subscriber’s home or business to the Internet over a local distribution network of copper, coax, and fiber lines – is healthy and strong. According to a 2017 report published by the International Telecommunications Union (ITU), global fixed-broadband subscriptions have increased by 9 percent annually in the last five years, aligning with data that shows 830 million young people are online, representing 80 percent of the youth population in 104 countries.

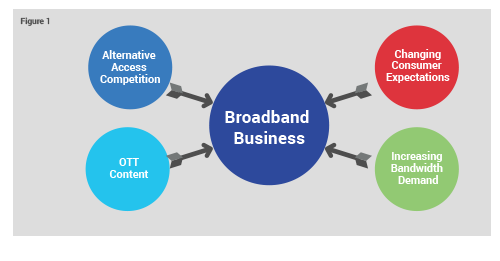

The increasing use of cloud services and streaming video has driven up bandwidth consumption and made the need for fixed broadband access more important than ever before. Unfortunately, increased data consumption driving growth in broadband subscriptions tells only part of the business story for service providers. While broadband subscriptions in the U.S. have grown in the past decade, the voice+video+data triple-play service bundle is in full retreat. According to data from IHS Markit, the number of cable customers subscribing to traditional pay-TV in the US has fallen by 10 million, over 17 percent, in the last decade. Bundled pay-TV service, like traditional voice service before it, has been eroded by Over the Top (OTT) streaming media services, leaving broadband internet access as the dominant component of the service provider business case.

Traditional telco and cable network operators are caught in a ‘speed trap.' Not one where they must slow down to comply with some theoretical broadband speed limit, but one where they must continuously upgrade their networks to provide ever-faster top speeds, yet garnering little additional revenue for their efforts. Neilsen’s Law of Internet Bandwidth has been remarkably accurate in predicting a high-end user’s connection speed grows by 50 percent per year. In the next few years, we will pass the 1 Gbps threshold for premium user connectivity speed, putting pressure on service providers to once again upgrade their access networks.

While the traditional view is that telco and cable operators battle for the subscriber’s connection, the real war for the consumer’s wallet is being waged by the OTT application megabrands – Amazon®, Google®, Apple®, Facebook®, and Microsoft®.