Coopetition: The New World Order of Communications Services

Video Market

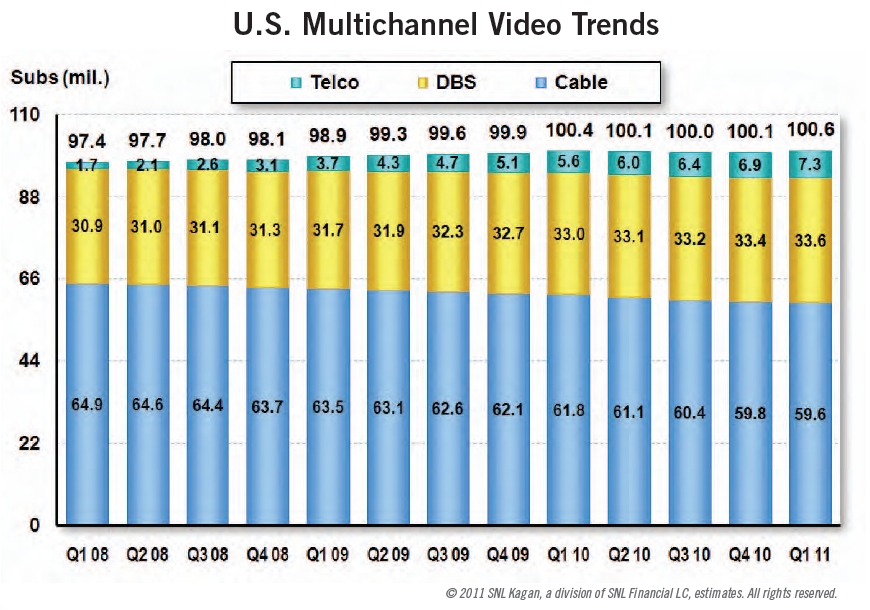

Telco video and TV services, as well as satellite-based video offerings, have no doubt taken a toll on cable's video revenues. A brief review of the chart in Fig. 1 from SNL Kagan shows the strong gains Telco-TV has made, and how telco has consistently bled video revenue from the competition.

According to a review of the most recent data, the top ten cable companies in the U.S. shed 1,620,000 video subscribers in 2011, while telephone operators with video offerings added 1,505,000 subscribers during the same time period. On the surface, it may look like Verizon and AT&T reached directly into the bank account of the cable industry and withdrew a billion dollars.

Now, you may be thinking OTT video services have severely impacted video offerings from both cablecos and telcos. And at one point this may have been the case. However, that tide appears to be changing direction. OTT services are indeed popular and inexpensive, but content libraries are often rather shallow and dated. Major fumbles by players like Netflix such as price hikes and loss of content has resulted in the shedding of millions of subscribers and the quality of service (QoS) for OTT services is often poor. It's also important to note that low-to-no cost services are proving to appeal to the lowest ARPU customers. As a result, multi-subscription households seem to be becoming the norm--and the piece of pie worth fighting over--whether that be a telco, cable, or satellite provider.

Research from the Leichtman Research Group supports this. While more and more app-enabled connected devices are being added to home networks (up 6 percent in the last year), this trend isn't driving consumers to âcut the cord,â as analysts originally predicted.

"Among all adults, reported time spent watching TV is similar to last year, and there remains little evidence of a significant trend in consumers 'cutting the cord' to their multi-channel video services to watch video solely via these emerging services,â said Bruce Leichtman, president and principal analyst for Leichtman Research Group. In fact, of the U.S. households sampled, only .1 percent dropped their multi-channel video service in the past year, and said they don't subscribe to an MSO because of Netflix or because they can watch all that they want on the internet or in other ways.