The Industrial IoT Digital Divide

Cost savings: Private 5G can be delivered at a cost much lower than public cellular or wired solutions. In fact, they are being offered today at a cost that rivals Wi-Fi.

Here are some real-world results from one 1,260,000 square foot distribution center wherein a private mobile network solution was recently deployed. Using only 17 percent of the Wi-Fi indoor access points and 6 percent of the outdoor access points, the solution was quick to install and offered these measurable improvements immediately:

Coverage: Indoor coverage increased from 78 to 99 percent throughout the 700,000 sq. ft. facility. Outdoor coverage increased from 59 to 95 percent throughout the 560,000 sq. ft. yard. This lit up the entire facility with high-performance wireless connectivity.

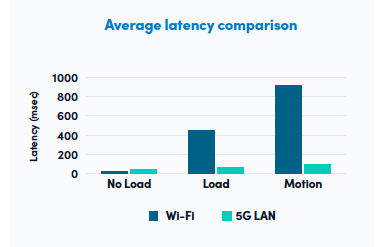

Latency: Measurements taken after the deployment showed average latency became consistent and was reduced by as much as 80 percent when compared to the Wi-Fi, especially when the network was under load or when devices are in motion. This means that scanners and AGVs perform as designed and react in real-time to any changes in the environment. (See Figure 1)

Figure 1. Average latency comparison

Total Cost of Ownership: The customer was pleased to find that the private wireless solution proved to be 47 percent the cost of Wi-Fi gear and 9 percent the installation cost, providing a TCO (Total Cost of Ownership) that is 32 percent of Wi-Fi.

Summary

The industry is at the very beginning of the move towards private 5G, but there is a real shift underway. I see three major drivers that will cause the market to take off in the coming years.

The first is the maturation of the private 5G device ecosystem. Every day more and more private 5G devices are coming onto the market, and as the more advanced 5G features are delivered — like ultra-low latency and 5G positioning — more sophisticated use cases like digital twins and machine vision can be supported.

The second driver is increased availability for spectrum globally. In June, the FCC announced that the areas in the US where shared CBRS (Citizens Broadband Radio Services) spectrum can be deployed is being increased, positively impacting thousands of businesses and millions of people. Globally we also are seeing an increase in countries setting aside mid-band spectrum for local licensing directly by enterprises. There is increasing government recognition of the positive economic impact of making spectrum directly available for enterprises to deploy private cellular networks.

The third factor is the growth of a neutral host model built on private 5G. As telcos start to abandon subsidizing DAS deployments for all but the largest enterprises, neutral host networks based

on private 5G networks will increasingly be recognized as a solution that allows staff and guests to access to access the public cellular network from a private cellular network.