As in broadcast video markets, CSPs must be able to accurately measure and assure their subscribers’ video QoE in order to monetize their services. Unfortunately, traditional methods of measuring quality do not translate to OTT video. Where broadcast video deals with a limited number of formats and a small set of known standards, OTT video must grapple with a vast number of formats and a large number of changing standards. In comparison to the broadcast ecosystem—a unified, single entity with end-to-end control—the OTT value chain is currently fragmented and, as a result, many parties involved in the OTT ecosystem are not able to realize this massive opportunity for monetization. We are in the early stages of an evolution. More and more people are viewing video content on the internet. This represents a shift from traditional broadcast video market to OTT video. Broadcast video advertising and subscription revenue in the US amounts to approximately USD$150 billion per year.7 The current shift presents service providers in the fixed and mobile networking landscape with a significant opportunity to develop new services that will ultimately replace legacy broadcast video revenues—if, that is, they can develop an architecture that delivers to subscriber expectations.

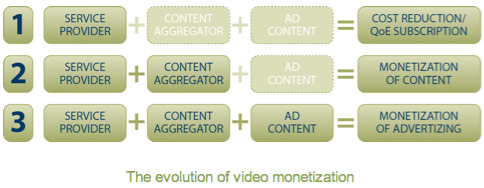

QoE-differentiated services are the first step in the evolution of OTT video monetization, followed by monetization through revenue sharing with content providers, and finally by monetization through targeted advertising.

CONNEXUS brings together service providers, content providers, advertisers, and leading network vendors to deliver open interoperability interoperability between network traffic management and content delivery systems to provide reliable high-quality, end-to-end video service delivery across the value chain, and a monetization platform that scales for personalized, on-demand content delivery for multi-screen consumption.

CONNEXUS GOALS:

- Promote the notion that service provider monetization of OTT video services requires a mind-set shift from that of selling data to marketing the application experience

- Leverage existing standards to define how OTT video is delivered and monetized, and govern interoperability within the ecosystem

- Accelerate the availability of integrated solutions across the OTT video ecosystem

Reliable, high-quality video traffic management is the first step to QoE-differentiated subscription revenue which sets the stage for content monetization and, ultimately, ad revenue. Avvasi is the award-winning company helping fixed and mobile service providers understand and leverage the opportunities created by the surge of internet-based, Over-the-Top video. Avvasi’s patent-pending, revolutionary video analytics eclipse traditional network analytics, offering highly detailed measurement capabilities that report video-based QoE, and a MOS-like score that accurately reflects the subscriber’s perceived experience with video content. Service providers around the globe are deploying Avvasi OTT video analytics to understand the network impact of new devices and subscriber usage patterns, plan and dimension network expansion and optimization solutions, while reducing subscriber churn and maximizing revenue. For more information, please visit http://www.avvasi.com.

- Neilsen, 2011. Based on total users of each media type.

- Nicole Perrin, eMarketer, March 2011, “Traditional Media: Dollaras and Attention Shift to Digital”

- Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2010–2015 (February 2011). Source: http://www.cisco.com/en/US/solutions/collateral/ns341/ns525/ns537/ns705/ns827/white_paper_c11-520862.html

- Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2010–2015 (February 2011). Source: http://www.cisco.com/en/US/solutions/collateral/ns341/ns525/ns537/ns705/ns827/white_paper_c11-520862.html

- Jeremy Scott, “YouTube Accounts for 13 Percent of All Mobile Data Usage”, www.reelesco.com

- Acision, Feb 2011 http://www.acision.com/News-and-Events/Press-Releases/All-Destinations/2011/Global-Mobile-Broadband-Report.aspx

- Combined reported revenue from major broadcast television operators, ad revenue and media sales (Nielsen, 2011)