By: Jesse Cryderman

The latest Visual Networking Index from Cisco predicts that for the first time in history, mobile connections will outnumber people this year. With a current worldwide population of roughly 7 billion, that’s a mountain of phones. But increasingly, it’s not a human being at the end of the line: in eight years, nearly 20 percent of all cellular connections will be occupied by machines. Cellular connectivity of the M2M variety is going into everything from traffic lights to energy meters to billboards, representing a massive growth opportunity for agile service providers and vendors. And by "massive growth opportunity," I mean "goldmine." Last October, the GSMA predicted M2M communications revenue growing to $1.2 trillion by 2020. Yes, that’s Trillion, with a “T.”

Although it’s an understandably hot topic, given these projections, machine-to-machine (M2M) communication is nothing new. Telematics systems, like OnStar, have been a part of our cultural fabric for more than a decade. However, it wasn’t until late 2009/early 2010 that industry heavyweights AT&T, Verizon (nPhase), Jasper Wireless, Vodaphone, and others launched large-scale initiatives (coinciding with price reductions for key components), that M2M really took off down its current path.

Admittedly many M2M connections are made over Wi-Fi or through a wired connection; while M2M devices will make up the bulk of the projected 24 billion connected devices that will exist by 2020, “most will connect with short-range tech, like Wi-Fi,” says Machina Research.

In this article, we will specifically look at the market surrounding cellular M2M connections. What does the landscape look like, and what are the most promising verticals? How are CSPs cashing in on the M2M explosion? What opportunities are blossoming?

Market Size

Machina Research released a detailed report of the M2M market space in concert with the GSMA in October of last year. Some key data points in that report include:

- Deployed M2M devices will grow from 2 billion in 2011 to 12 billion in 2020.

- M2M devices will outnumber traditionally connected devices by 2020.

- Of the 12 billion M2M devices in 2020, 2.3 billion will connect with cellular networking.

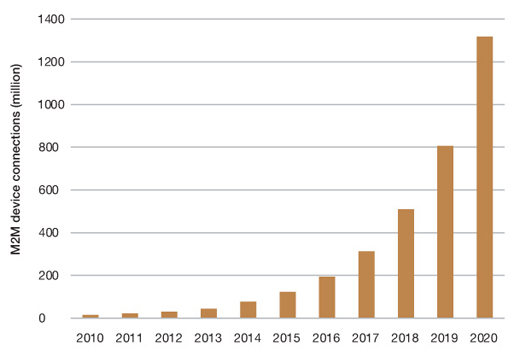

Similar research performed by other analyst firms supports these predictions, and forecasts the classic hockey stick growth curve, as you can see in Fig. 1.

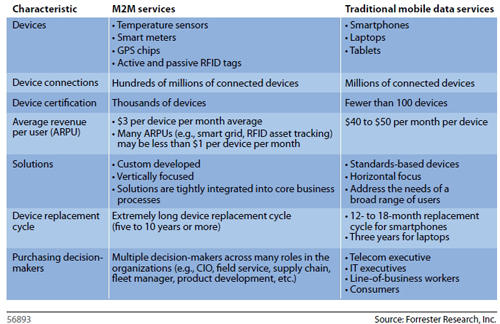

Despite the rapid growth and revenue opportunities, the market is very different from traditional mobile data services market, as you can see below in figure 2.