Welcome to Smallville

Small cells, evolved

The latest small cells are smaller and more lightweight than before and consume less power than their predecessors. They also support multiple access technologies and are designed from the ground up to be a major part of the heterogeneous networks, or HetNets, of the future.

The major innovations are occurring in the public-access and SMB/enterprise-market segments. Small cells in these segments can support up to 64 users and feature 3G, 4G and carrier-grade Wi-Fi connectivity. The need for greater indoor coverage is also driving innovation: Ericsson’s newly released Radio Dot System crams a small cell into a 10-ounce disc that resembles a smoke detector.

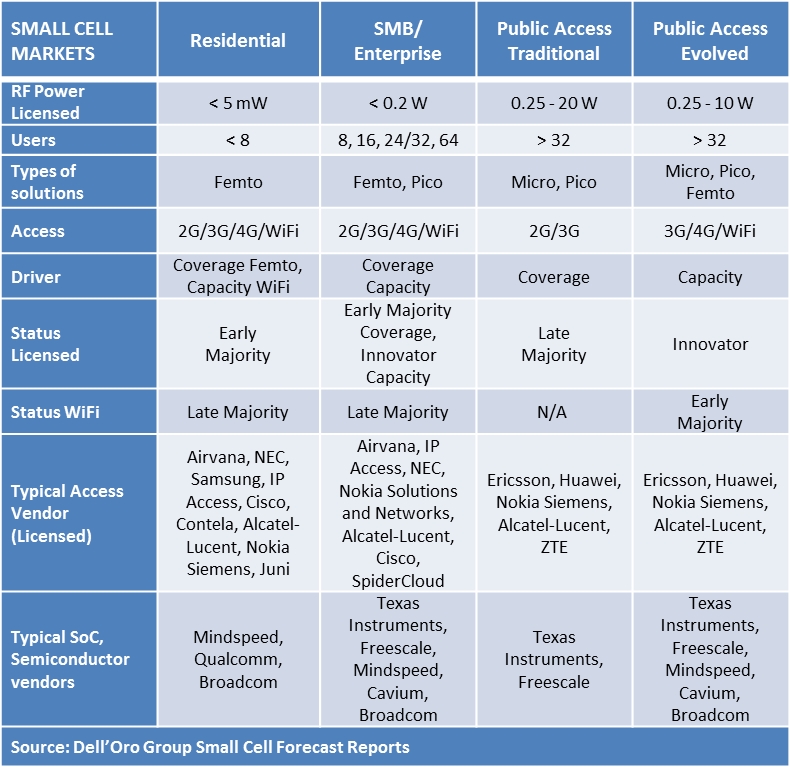

There are numerous addressable markets for small cells, as illustrated in figure 2 below, with varying access technologies, innovations and vendors represented in each one:

Market trends

As connectivity is extended to machines, and as pervasive, high-speed mobile broadband becomes a standard expectation of consumers, small cells will open up new market opportunities. They won’t all be equal, but if mobile operators were to target one segment, enterprise would make the most sense.

Alcatel-Lucent surveyed more than 2,500 IT executives in seven countries in 2012 and found that nearly 44 percent of enterprises were willing to pay a premium in order to receive better indoor coverage. The driver for this willingness is simple: as businesses of all sizes rely on high-speed mobile broadband to a greater degree, the service issues caused by poor indoor coverage become increasingly painful and are exacerbated by 4G LTE, which oftentimes has worse in-building reception than 3G.

Beyond coverage, the Alcatel-Lucent survey identified other areas of importance for growth in the enterprise market. Small-cell solutions that integrate with legacy PBX systems and Wi-Fi are crucially important to the vast majority of IT buyers, while turnkey solutions are also viewed as compelling to purchasers, especially as the size of an organization increases.