Network Visibility Requirements for IoT -

and the Questions CSPs Need to Ask

By: Miguel Carames

As the IoT population looks to surpass the number of non-IoT devices by the end of the decade, it’s time for CSPs to change the way they think about their business and their network. IoT calls for greater precision and network intelligence that acknowledges that IoT will create a hyper-segmented ecosystem. To fully monetize the opportunity behind connected things requires all aspects of the technology stack to come together in synergy, and to do this requires acute network visibility that enables CSPs to address the hard problems. Questions such as: Do you have the network intelligence to detect low-powered IoT, how do you identify mission-critical IoT vs. consumer, or what’s your level of confidence that roaming IoT is performing as required? The IoT era is here: Do you have the network visibility necessary?

We are about to witness massive IoT growth. The numbers tell the story:

- 5.8 billion: the number of licensed-cellular IoT devices by 2030, up from 3.5 billion in 2023 (GSMA).

- 46PB (petabytes): global cellular IoT data generated in 2028, up from 21PB in 2024 (Juniper Research).

- Wholesale IoT roaming will reach $8 billion by 2028, a 16 percent average annual growth between 2023 and 2028 (Kaleido Intelligence).

In this context, it’s important that CSPs ensure that all corners of their networks are equipped to not only meet the demands of IoT but also help identify opportunities to maximize revenues. Here are the top questions CSPs need to ask.

Do I Have the Network Visibility Required to Maximize IoT Roaming Revenues?

Kaleido Intelligence projects that wholesale IoT roaming will reach $8 billion by 2028. However, the diversity of devices and use cases is making it difficult for CSPs to fully monetize this opportunity. For example, low-power IoT devices and sensors, commonly used to remotely monitor environments such as smart cities, agriculture, and manufacturing, are increasingly joining the IoT roaming category. Juniper Research projects that there will be more than 490 million low-power IoT roaming connections by 2028, a growth rate of 560 percent from 2023. However, because these devices consume less data and have intermittent connectivity, it can be difficult to identify them, which is especially true for devices inbound roaming onto a visited network. This creates a huge potential loss in revenue for CSPs, particularly when Kaleido forecasts that IoT roaming connections that consume less than 10MB per month will represent 59 percent of the total IoT roaming connection base by 2028.

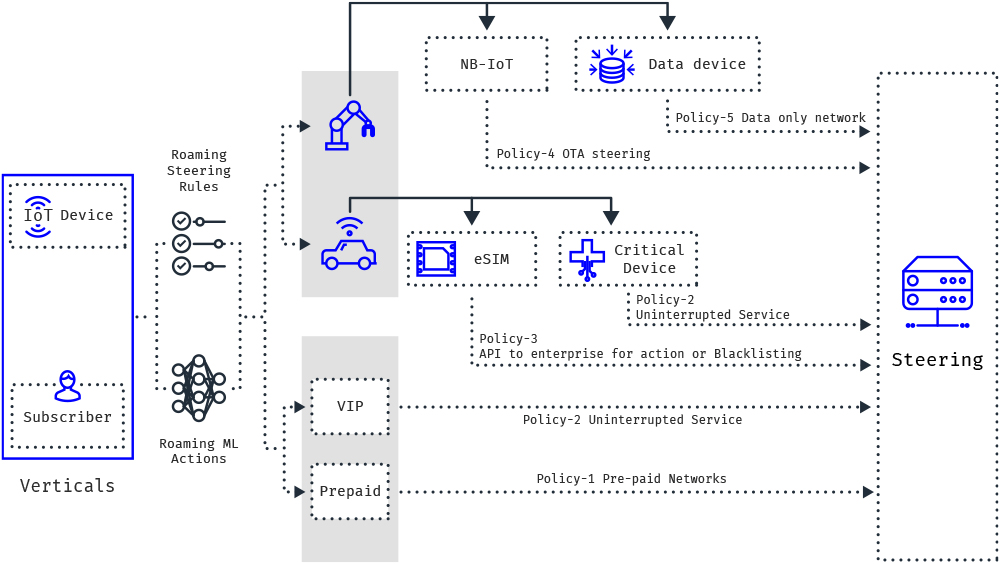

Figure 1. Roaming Steering

A few years ago, GSMA defined the machine-to-machine (M2M) roaming transparency initiative. However, practical experience proves that detecting low-power devices is only possible with AI-based deep analytics. AI-based analytics is required to detect, monitor, and analyze the billions of IoT devices connected to the network in order to form a 360-degree view of the IoT ecosystem. This, in turn, gives the CSP visibility to monitor the network and service performance delivered to IoT devices so that they can provide superior connectivity and experience on every IoT device.

But it’s not just detecting the devices that’s important. CSPs must also understand the different device categories to ensure the right traffic and pricing policies are consistently applied. This is where IoT Packet Printing plays a critical role. It combines carrier-class security, behavior analysis, and traffic analysis to automatically identify the device category, and it can detect misuse and prevent fraud or abuse in the event of compromised or malfunctioning IoT devices. Traffic and pricing policies for IoT are often more complex than those for retail.

Therefore, CSPs need to ask: Does our policy engine have the AI and automation capabilities to manage the complexity and scale of IoT?

Steering of roaming is another area where IoT brings greater complexity than traditional telco services. (See Figure 1 above.)