|

|

Other providers started years ago. XO Communications has seen the Ethernet over Copper wholesale opportunity and is marketing its mid-band services to resellers who are then targeting small businesses. This then allows XO to focus on larger clients’ up-market. XO’s footprint has grown considerably, now reaching nearly four million buildings and ten million businesses across 39 markets. For resellers, that investment improves the overall economics of provisioning these services.

|

|

“Even for a 10% price increase, businesses are significantly less likely to switch to 100-Mbps service.” |

|

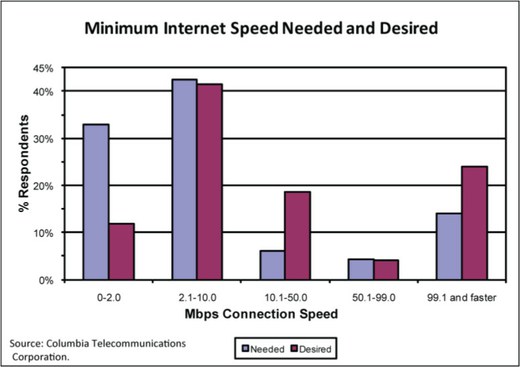

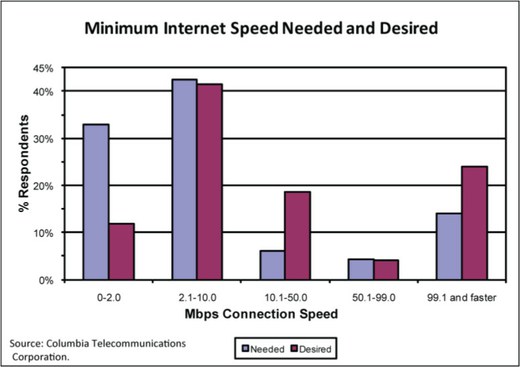

business owners who are more

focused on price. With broadband

speeds mostly satisfying, price remains

a bigger concern for small businesses,

as it so often is. And it’s here that fiber

suffers a major disadvantage. The vast

majority of small businesses in SBA’s

survey (about 80%) pay less than

$100 per month for broadband service.

SMBs are largely uninterested in

|

|

|

Chart 2: Small-Business Bandwidth Needs and Desires Survey

Chart 2: Small-Business Bandwidth Needs and Desires Survey

|

|

As fiber footprints grow, will they

automatically trump EoCu? Not

necessarily in the small-business

space. In this weak economy, the

broadband speed war is failing to

capture the attention of many small

|

|

upgrading to fiber-based service if it

means they have to pay even a little

bit more to get it. “Even for a 10%

price increase, businesses are

significantly less likely to switch to 100-

Mbps service,” the SBA noted.

|

|

|

|

|